Travel Insurance: Why I Was Wrong & Lessons Learned

Confession time: out of the 10+ countries I’ve visited, I’ve never purchased travel insurance. That’s sound crazy, but I didn’t think it was a necessity. For most of my trips, I only brought my carry on luggage and a personal item. So I never worried about my luggage not arriving at my final destination. Layovers were spaced out enough that delays were irrelevant, and I never considered canceling a trip. However, a recent incident made me realize the importance of travel insurance and why I was wrong.

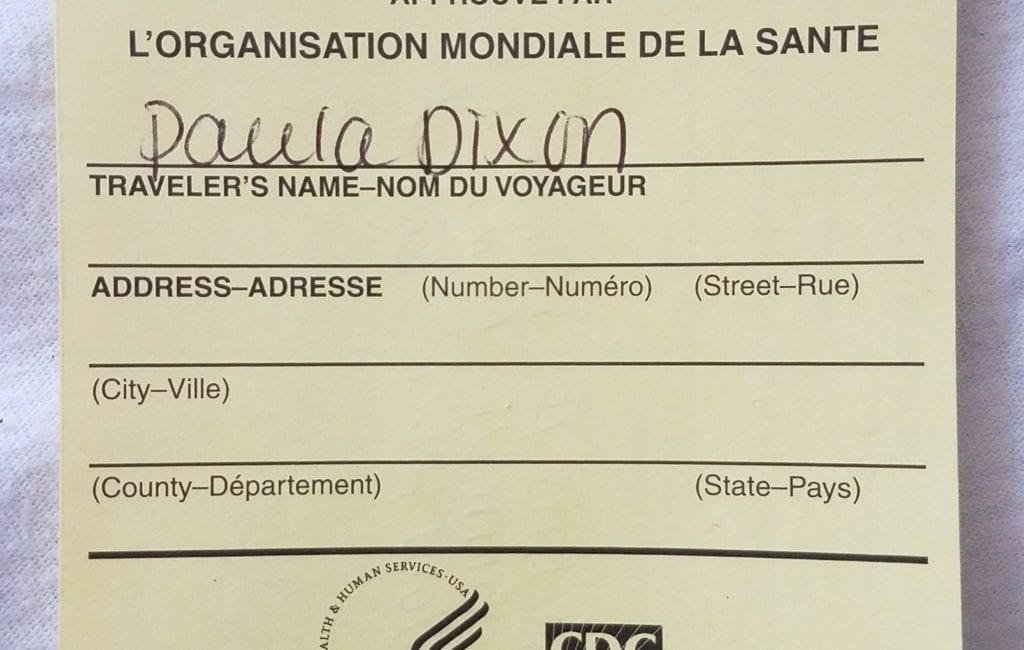

I was planning a trip to Ghana in October to visit a friend who’s in the Peace Corps. Got my Yellow Fever Vaccination Card, then, bought my flights in early September through Vayama. I’d never used this third-party booking site, but it was an option on Skyscanner so it felt reliable. As I was going through the payment process, Vayama offered travel insurance through AIG for an additional $100. I instantly thought to decline, but thankfully I sat there and re-evaluated my decision. Ultimately, I bought the insurance because I was checking a bag and paid $1,000+ for the round-trip ticket. I would’ve hated for something to go wrong when I spent so much money on tickets.

Due to unforeseen and personal reasons, I had to cancel my trip a couple of weeks later. Unaware of what insurance I bought, I was a little nervous that my situation wouldn’t be covered. This brings me to my first lesson when deciding on travel insurance:

Understand what your insurance covers

Honestly, I was completely unaware of what my insurance actually covered. Luckily, the insurance I bought through Vayama included a “cancel for any reason (CFAR)” option. This insurance coverage was self-explanatory, I’d get reimbursed for canceling my trip for ANY reason. Had I not dished out $100 for travel insurance, I would’ve taken that loss and paid for my $1,000+ tickets. Which brings me to my next lesson:

Don’t be cheap with your insurance

Anyone who knows me knows I’m cheap. I refuse to pay for things I deem to be unnecessary, or to pay more than needed. However, this notion shouldn’t apply to travel insurance. The cheapest travel insurance may not provide the best coverage when you really need it. $100 may sound like a lot, but in hindsight, it would suck to not have coverage for a new flight. Or, lost/stolen luggage, or even medical expenses. Which brings me to my next point:

You’re NOT invincible

When you’re young, you don’t think something bad will happen to you. If you’ve had no previous ailments or even travel issues – you may think you’re invincible. But, for those who travel often, you know there’s always unforeseen things that can happen. And that feeling of being lucky, or invincible, goes away QUICKLY. An injury could happen, leading to a visit to the hospital and having to cancel an upcoming trip. Or, your baggage could get lost or stolen while on vacation. This is why it’s important to obtain insurance, because anything is possible before or during your trip.

This situation really taught me the importance of travel insurance. I really lucked out buying insurance for the first time, EVER, in this situation – but, it could’ve went completely differently. The process for filing a claim and getting a reimbursement was surprisingly simple. I can’t speak for other companies, but AIG made the entire process seamless and painless. From now on, travel insurance will definitely be a priority in my travel planning!

What are your thoughts on travel insurance? What company is your favorite for travel insurance?

Charlotte Kerr

Wow you’re so lucky that you bought the insurance for the first time you needed it! Last week, and only five days in to my 6+ month travels I had to have an emergency dental appointment to remove an infected wisdom tooth. I have to wait for the insurance company to contact the dentist for confirmation it was an emergency for them to pay out but hopefully that won’t be an issue!

Paula

Yes, I’ll NEVER take that gamble again! Omg, that’s crazy – I hope you’re feeling better and everything works out with your travel insurance!

Emma

I just spent 3 nights in hospital in Mumbai due to severe food poisoning. I always travel with insurance anyway, but it would have cost me a FORTUNE had I not had it. I always encourage people to get insurance. I think I’ve used mine on every trip so far. (Oops!)

Paula

Wow, that would’ve been terrible if you didn’t have travel insurance! I’m so glad I learned the importance of travel insurance.

Annette

I think a lot of people misunderstand travel insurance. Great article!

Paula

Thank you! I know I was one of those people, unfortunately.

Kim Feinzilberg

Great advice! I will definitely consider travel insurance on my next adventure #gltlove

Paula

Please do, you won’t regret it! #gltlove❤

Brie Flanagan

We spent almost $2500 US on our travel insurance. Luckily we haven’t had to use it, yet, and I hope we won’t have to. I hated shelling out that cash since it is so much money we could have spent actually travelling. I know I’ll be grateful when we have to use it though.

Paula

Yes, it’s always great to have travel insurance because you never know what’ll happen!

Jessica

I’ve always wondered about travel insurance. Thank you for sharing your story!

Paula

No problem, I’m happy to know it was helpful ❤