How I Paid Off Student Debt While Traveling

One of the most popular questions I’ve been asked is how I paid off student debt while traveling. So, I’m walking you through those four years of my life, and how I prioritized traveling AND paying student debt.

Disclaimer: I only had federal student loans, no private student loans. I’m also in no, way, shape, or form a financial consultant or expert. Just sharing my story and what worked for me.

On March 7, 2019, less than four years after graduating college with $36,000 in debt, I paid off my student loans! I felt like a kid on Christmas Eve the night before because I was too excited to sleep.

2015

Total Student Loan Payment:

$0

Total Trips:

2

While in college, I took advantage of different programs and opportunities that would allow me to travel. For example, the summer entering my senior year I studied abroad in Spain. Which also allowed me to visit England and France. Most of the funds for this opportunity came from two substantial scholarships, financial aid, and a $2,000 loan. Immediately after coming back from Spain, I traveled to Miami to continue my 21st birthday celebrations. Then, I moved to NYC and stayed with family for the rest of the summer for an internship opportunity.

For my last semester as an undergrad, I spent my spring break in Barbados through my college’s “Journey Leadership” Program. The only things required of me was a $200 deposit, and help getting funding approved by the Student Government Association. Everything else was completely paid for!

After graduating college in May 2015, I was unemployed with $36,000 in student loan debt. It took me four months to find a position, which ended up being a paid internship at Time Inc. Since this was an internship, I knew I couldn’t afford to live on my own in NYC. So I opted to stay with family to cut the cost of rent and utilities.

December rolled around, meaning my six month student loan grace period had ended. Since I didn’t have a solid income at the time, I immediately requested an income-driven repayment (IDR) plan. This dropped my monthly payments to $0.

Towards the end of December, I landed a full-time job in my hometown. So, I left NYC to live back at home in Boston. The decision to live at home was both a want and need. I wanted to be back home with my immediate family. I also knew I needed to live at home because of my strong desire to pay off my student debt. The idea of being able to continue traveling was an added plus.

Biggest lessons this year:

- Take advantage of travel opportunities through your college. Even though I was getting ready to graduate, I was still looking for last-minute opportunities to travel through school. A lot of college-related trips are deeply discounted.

- Take advantage of internship opportunities in other cities. I was able to travel, and live in another place, for brief periods of time because of internship opportunities. Understandably, this might not be an option for everyone, especially if it isn’t a paid position, but it’s worth considering.

- Be proactive and realistic with your loans. Due to financial uncertainty, I knew I needed to notify my loan provider of my economic hardship. This allowed my monthly student loan payments to reflect what I could realistically afford at the time. This also helped in the long run since my $0 monthly payment plan lasted throughout the calendar year. So when I was finally working full-time, I was able, and willing, to make larger payments.

- Reassess your budget. This is a reoccurring takeaway when paying off student loans and traveling. I immediately realized that in order to maximize my student loan payments I’d need to move back home. This decision also allowed me to travel more frequently.

2016

Total Student Loan Payment:

$12,699.38

Total Trips:

4

At the top of the year, I had an honest conversation with my mom about expectations with bills and finances. I took on bills I knew I could afford — the rest of my money went towards student loans and travel.

This year in particular was complex for me. I was excited for my first “big girl” job, but also coping with the loss of my father and grandfather. I’m not sure how, but through it all, I stayed consistent with student loan payments, and traveling.

I immediately started paying off my student loans in January, initially just paying off the interest. However, when I researched, I realized I should also focus on paying the principal balance. So, I started making large payments monthly to cover the interest and principal balance of ONE loan. Towards the end of the year, I re-certified my IDR plan.

Travel-wise, this year brought many firsts. My first time planning my own travels with friends to Copenhagen, Edinburgh and Berlin. Also, my first time traveling solo, which I did in Barcelona. At this time, I was more of a backpack traveler — essentially picking cheaper options on flights, accommodations, etc. This ensured I had money left to pay my loans and day-to-day things when I got back home.

Biggest lessons this year:

- Do research on your particular loans. Doesn’t matter if it’s private or federal, you should educate yourself on your loans so you know what to expect. This includes the lenders interest rates and repayment term/options.

- Research tips on most effective way to budget and pay off loans. Doing research helped me realize two things:

- I was only paying off the interest, and not the principal balance of my loans. Making larger payments helped me get ahead of the accrued monthly interest and make strides in decreasing my principal balance.

- I needed to focus on one loan (principal balance) at a time. Focusing on one loan at a time helps you feel/see progress being made. Once you’ve paid off one loan, it builds momentum to continue on to the next one.

- Create a realistic travel budget. This year was my first time planning my own trips, so I was in charge of my own budget. Since I just got my first full-time job, and was getting the hang of “adulting”, I wanted to spend modestly. So, I was willing to pick flights with layovers, sleep in hostels (or airports), take public transportation, etc.

2017

Total Student Loan Payment:

$12,706.71

Total Trips:

6

By this point, I was consistently making large payments to my student loans. Knocking out my 11 loans, one at a time. I continued to find ways to reduce unnecessary spending and keep a realistic budget. This allowed me to budget money for travels and day-to-day necessities, while also keeping a savings account.

Based on my revised budget, I was able to travel domestically and internationally six times this year. Miami, New Orleans, NYC, Puerto Rico, Toronto and Thailand (Bangkok, Krabi and Phuket).

Biggest lesson this year:

- Find unique ways to save money, such as:

- Make your own coffee instead of spending at Starbucks everyday.

- Meal prep and cook instead of buying lunch or going out for dinner constantly. This allows you to work on your cooking skills, and Pinterest is a great platform to find meal ideas.

- Modify how you socialize by having friends over (or go to their place) for wine and pizza night. This would be cheaper than clubbing or out for drinks.

- Shop for things you actually need. I like to shop online because I can see my total and make a logical decision on what’s needed.

- Find discounts and coupons. Anyone who knows me, knows I’m the QUEEN of finding discounts. Finding coupons/discounts saves you a few coins when buying essentials, or things you want. All it really takes is a couple of minutes of research. For instance, with clothes, I use retailmenot.com. Also, I always share my referral codes because I get money back. Here’s my shameless plug:

- Airbnb: Click here for $40 off your first booking

- Lyft: Use code PAULA364940 for credit for your first ride

- Evaluate transportation options. I live and work within a major city with public transportation. My monthly pass costs $90, which is significantly cheaper than having a car. Depending on where you live/work, you should evaluate what modes of transportation are available and cost-effective. Ride-sharing apps like Lyft have membership plans, you can also walk, scooter, bike, etc.

2018

Total Student Loan Payment:

$7,974.70

Total Trips:

4

This year threw an unexpected curveball in my student loan payment progress. At the top of the year, my IDR became a Pay As You Earn (PAYE) plan. Basically, FedLoan charged a monthly payment amount based on my salary — mine was $84.38. However, I left my full-time job in February, which meant I couldn’t afford to make that monthly payment amount. So, I immediately sent a new IDR plan request, which put my monthly payments back to $0. I stopped making payments until I started my new position six months later.

Although I was unemployed for half of the year, I managed to travel four times. From Mexico (Playa del Carmen and Tulum), to Miami, Montreal, and NYC. Three of these trips happened primarily because of my savings. And since I was still living at home while unemployed, I wasn’t as stressed about finances. I also strategically:

- Picked destinations I was familiar with and/or would give me more bang for my buck

- Traveled with folks who understood my budget and financial situation

This way I could still stay within my $1,200 travel budget. In August, I found a new position and began paying my student loans again in September. By this point, my 11 loans dwindled down to only a handful. I decided to celebrate my new position and closing in on my student loan payments with a trip to Montreal. Since Montreal’s close to Boston, it was a nice, quick and cheap trip.

Biggest lessons this year:

- Pick cheap destinations. Since I picked familiar and/or cheap destinations, I was able to get the most out of my travel savings. I chose destinations based on:

- Loved ones who lived there and were willing to let me stay with them

- If my home countries currency is stronger

- Previous experience at location

- Have a savings account. I really can’t stress this point enough, but saving money is how you’ll be able to travel. Even while unemployed I traveled because of my savings. My girl, Sabatini (Saba) of My Tasteful Ventures has an amazing #roadto1000 campaign on her Instagram. Essentially, Saba saves all the tips from her serving + bartending jobs in a jar until she reaches $1,000. Don’t work a job that gives tips? Just save the spare change you get during purchase transactions. If this method doesn’t work for you, you can always:

- Open up a savings account. Have a portion of your check go directly into your savings account. Also, make sure the savings account you choose gives a good interest rate. You can also open a savings account specifically for traveling or student loan payments. So all the funds going into that account is for those specific expenses.

- Give your money to someone you trust and is great with money. My family does this with me as I’m very good at managing money. Also, this helps stop them from splurging on things unnecessary simply because the money is in their possession.

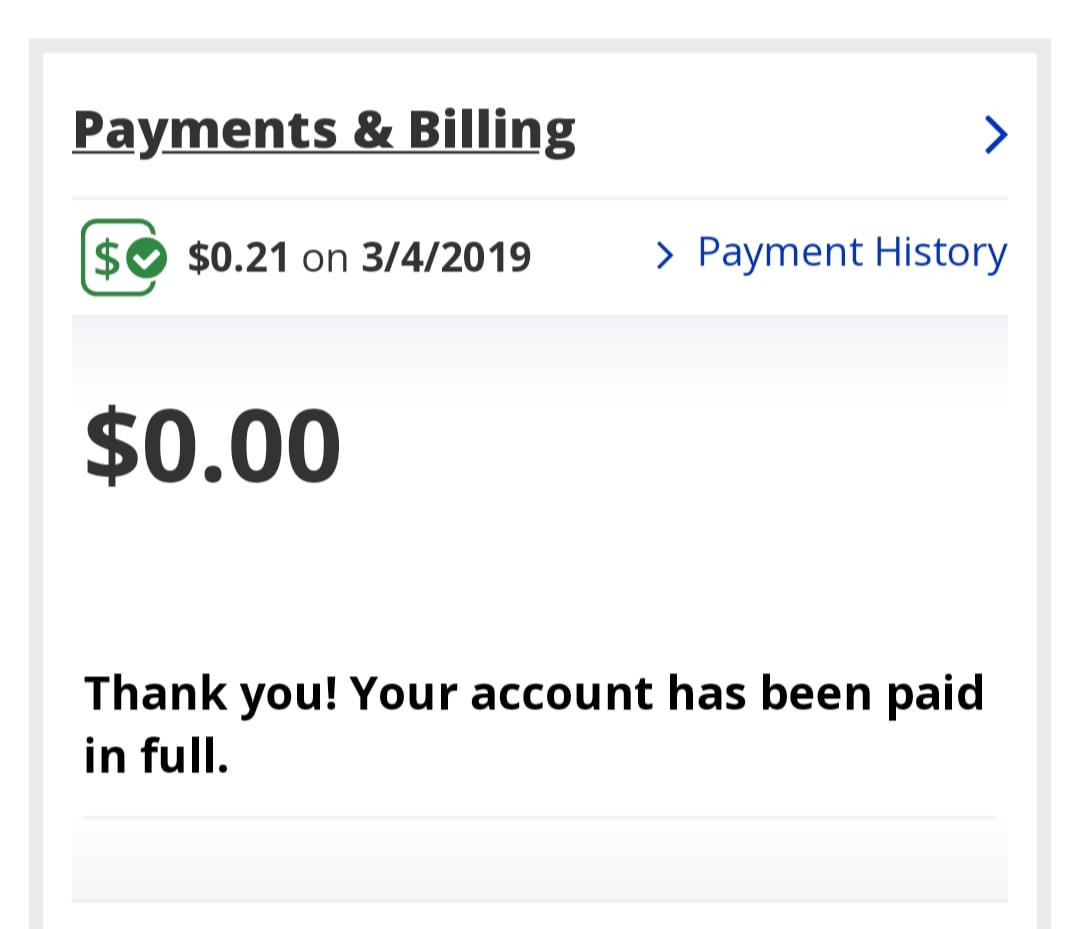

2019

Total Student Loan Payment:

$4,453.55

Total Trips:

5

I started 2019 with trips to Jamaica (Ocho Rios), Miami and Colombia (Medellin & Cartagena) already booked and planned out. After my trip to Jamaica in February, I made my last two student loan payments and was officially debt free in March. To say I was excited is an understatement! I couldn’t believe I paid off student loans while traveling, only three years and 10 months after graduating college. I still can’t believe it honestly, especially as I dealt with life transitions.

Additional tips:

- Use tax refund for savings and/or student loans. Every year that I got a tax refund, I’d split it in half. The first half went into my savings, and I’d pay my student loans with the other half.

- Work a “regular” job. I use the term “regular” loosely, but essential work a 9-5, 8-4, 12-8… whatever a typical work-day is for you. This is the main way I’ve been able to save money for my trips. I understand working a regular job isn’t for everyone, but it’s a steady paycheck. And, if you’re like me and enjoy your 9-5 job, then this option shouldn’t be an issue.

- Make extra cash by selling things. When unemployed after graduating college, and for a period of time after quitting my first full-time job, I’d sell things. I had a lot of old electronics and clothing lying around that I didn’t wear/use. Often selling through Ebay, Poshmark or one of the other millions of apps that allows you to sell things. This was an easy way to make fast cash.

Olivia Sutton

Wow! Your story sounds really similar to mine! Even though I’m still working on my student loans, strangely enough COVID-19 is making it easier to pay them thanks to the halt on my monthly payments through Edfinancial! The key takeaway I took from this was plan ahead and research! Thank you for writing this post!

Paula

Hey Olivia, I’m so happy to hear that you found this post helpful! I was honestly a bit hesitant to write this initially since it isn’t within my typical niche, but lots of folks reached out asking for insight. I agree with you in that COVID-19 has made it easier for folks to pay off their loans quicker, if they can afford them of course.